Fintech Software Development Guide for Quick Success

‘Finance’ and ‘Technology these two keywords led to the rise of the fintech software development. Technology has transformed the way we do everything – from shopping to networking, and from hospitality to education. Now it has taken charge of the financial services.

“Fintech is changing the finance sector just like the Internet changed the written press and the music industries. In what is a stagnant sector monopolised by banks, finance is ripe for innovation and fintech is unquestionably the catalyst needed for change.” – Philippe Gelis, CEO of Kantox

Over the last few years, we have seen a number of Fintech startups to crop up. Such as NerdWallet, Due.com, Stripe, LendUp, Trulioo are some popular names who are putting their best to use technology and make it easy for the people to invest, lend, make payments or apply for a loan.

Why there is a sudden upsurge? Why are a number of startups after building a finance app?

- Well, it is all due to the millennials.

It is appealing to them since they grew up with mobile, and would love to handle their financial habits through the same device. As per the IDC, a market research firm, the millennial considers the financial services as yet another consumer product. But this is not the only alone reason, that is keeping the financial market look for a new future ahead. There is much more.

The convergence of new technology and predictive analysis through big data is allowing the companies to harness information in new ways. Whether it is a personalized investment plan or approving a loan through an underwriting process. These people just love to ‘kiss’ technology and move ahead!

What is Fintech?

Well, in one of my last blog I was talking about why fintech software development like Mint and how it has shown a spur. Since a number of companies in financial sectors are embracing software to stay ahead in the competitive market. There are a number of fintech app ideas introduced by startups, who are disrupting the existing financial models and larger financial corporations that are less into technology.

However, larger financial corporations are showing increased interest in creating a finance app to improve their offerings. For example, American Bank, Citibank, UBS AG, Banco Santander etc are some big players who have invested hugely in fintech software development and maintenance.

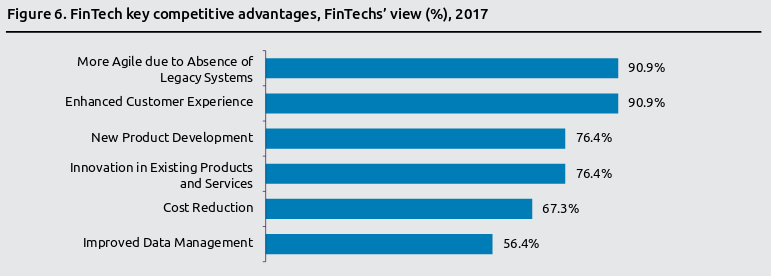

If you look carefully at the report published by Capgemini in 2018 about the Fintech industry clearly telling that 90% of the fintech firms are trying to enhance their customer experience. And 76% cited that they must heavily invest in fintech software development to scale-up and create financially-viable business models. The report showed that Fintechs have raised nearly US$110 billion since 2009. However, the industry might fail if they do not build an effective partnership between disruptive fintech startups and traditional financial institutions.

It is a multi-billion dollar industry, still dominated by a number of startups. But a collaboration is a must to enhance customer experience.

Why Do You Think There is An Upsurge All Across The Globe?

Behind every upsurge, there is a prolonged stimulation that instigates an upsurge or an outbreak. For fintech industry, the rise of startups, stress on building finance apps for any type of financial business also has some solid reasons behind.

- The traditional financial institutions and the anger of the customers on them for failed experiences. As a bank customer dealing with traditional systems or technology, the pain is much higher compared to those who have opted for mobile banking.

- Too many paperwork while applying for loan, mortgages or credit cards. And the slower pace to process the paper is irritating to the customers.

- The Internet has hugely influenced our relationship with money just as they improved the education, newspaper and music industries. Customers thus want the end of those old legacy systems over their finances.

- Traditional institutions have monopolized the business, but fintech has made things transparent and offer services at cheaper rates. This is something on which fintech startups has put a bet and collecting brownies.

- Payment options were so stringent as security was always a major concern. But peer to peer payment app or creating a wallet app has made things soluble and security is still in safe hands. (Yet critics will have their own round of opinion 😉 )

What Are the Advantages of the Building a Finance App?

Fintech app ideas have leveled the financial market for people, giving them access to services previously occupied by the wealthy or only with people of economic stature.

Say for investment, with technology and data it is cheaper and easier to bring the investment advice to the masses. This indicates that with fintech software development is a typical asset level which is open to anyone.

Think of lending. In the earlier days, there were only a few data which the underwriters have while assessing the risk. This made a huge number of people to turn down or were charged with higher interest rates on their loans. But these fintechs are relying on different kind of data while underwriting. They are providing people with more personal access and business capital. Thanks to the data scientist for making business lending this easier.

When it comes to fintech software development, you will find that there are a number of players and services. Most are good, innovative and give you the right support. But what they lack is a collaborative environment for which they need to get into an effective partnership with the traditional institutions, as per the Capgemini Reports 2018.

Which Businesses Are Looking for Fintech Software Development?

Fintech software development has taken an entry into the traditional financial market, especially bank and we have seen it acting as a disintermediating factor. However, in 2018 we are seeing that it is no longer the bank alone. A number of other financial domains like lending, equity or trading is also ready to invest largely in the fintech software development.

As more and more investment flows into the world of fintech, they will turn more mainstream with time. Their market share is soon to rise and many have soon become household names like Mint.com or NerdWallet.

Some businesses which are likely to invest in creating a finance app for auxiliary financial services includes –

Money Transfer – Fintech application development is common in this sector. Companies such as TransferWise, Western Union, TransferGo have sprung up to offer peer-to-peer money transfers based on the mid-market value.

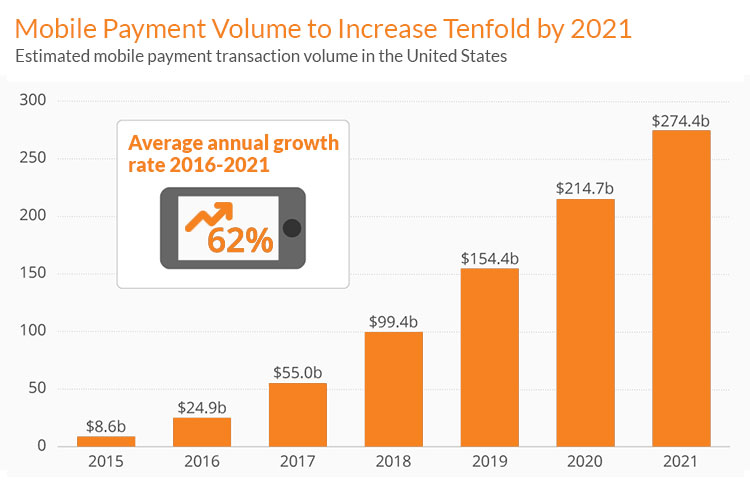

Mobile Payments and eWallets – This fintech software development saw a steep growth and thanks to all online applications from Uber to Amazon.

Allowing people to conduct fund transfer and transaction over the mobile have stolen a march on banks. And good examples are like PayPal, Apple Pay etc.

Equity – For the business in equity, fintech software development has started to become a common term. Equity crowdfunding was the answer to many startups, especially during the global financial crisis. The leading crowdfunding platforms include Kickstarter, Indiegogo, and Seedrs. They are really changing the world of equity through mobile apps.

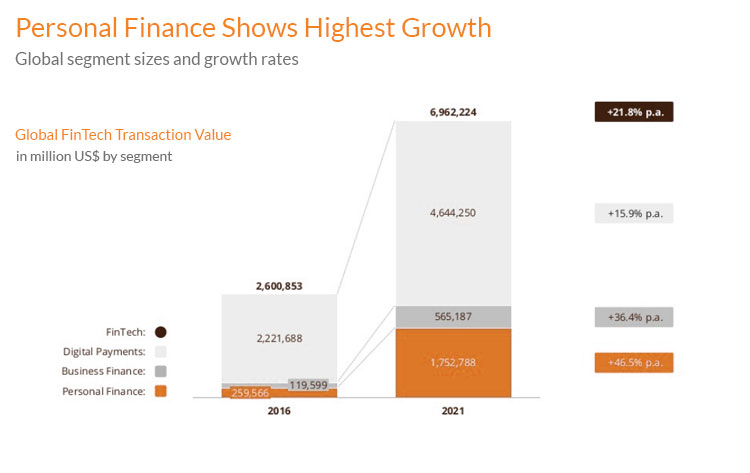

Personal Finance – Creating a finance app for budgeting or apps like Mint is very popular these days. They are providing web and mobile services to help users handle their finances, income, and expenditures. The software entails categorization, data visualization, spending trends etc.

A slew of fintech startups are helping the micro saving industry and earning loyal customers by rewarding the same. Digit and Acorns as two examples of popular players in the fintech saving space.

Some businesses which are likely to invest heavily in creating a finance app for core financial services includes –

Online Banking – Banking is one of those sectors in the finance industry hugely affected by the rise of mobile apps. Catering to millennials to conduct daily banking tasks through mobile, collect rewards and acquire a low-cost alternative to a traditional bank. These online tools help the user to budget, manage and smartly meet the saving goals.

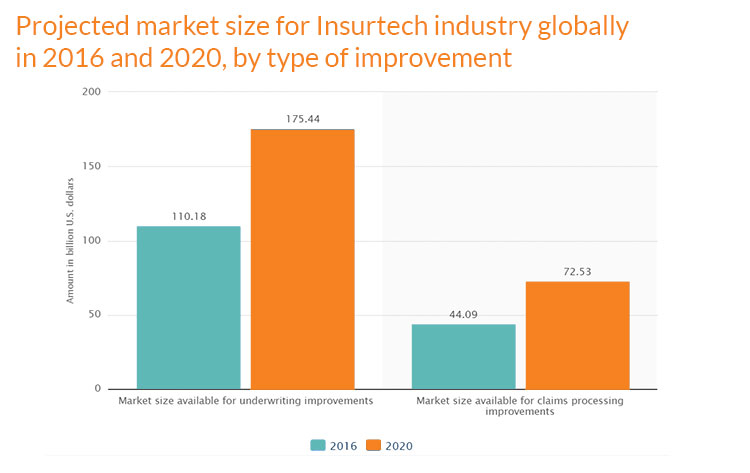

Insurance – This domain was explored by the fintech startups and they have started creating finance apps for the same. As the process is too arduous in insurance domain, so a handful of startups are aiming to change the approach.

To upgrade the customer experience and reduce the cost, so they have gone the app way. They invested in developing fintech apps for insurance companies such as BIMA, Metromile, GEICO etc.

Trading Platform – People can now trade through online platforms. Some fintech application development is currently focusing on developing apps that do the research for stocks and funds. Such fintech platforms are able to offer much lower fees than typical banks and the stock traders.

Some new technology-based fintech application development that is in the news these days are –

Blockchain Technology – As per the Global Blockchain Technology Market study, blockchain will show a remarkable growth with CAGR 55.59 between 2017 to 2021. The blockchain is a decentralized ledger that provides immutability of data and enables fault tolerance system.

Regtech – Regulation Technology is one of the targeted sectors and a number of fintech app ideas revolved around this domain. With the use of Big data, computing and machine learning Regtech have seen far advancement in –

- risk data collection

- monitoring payment transactions

- identification of clients

- legal persons

- trading in financial markets

Some names in this Fintech application development includes PassFort, Trunomi etc.

When Fintech Application May Not be the Solution?

Fintech applications appeal to the millennials for a number of reasons. Since most of the services are easy to understand like borrowing money or making a purchase. But things which have a complicated process of financial execution must not have app-based solution may not be enough.

Say if you need a term life insurance, it requires a simple transaction. However, if you need a complex insurance product, apps cannot help. A financial software development cannot help to ease the life of customers in complex processes.

Wrapping Up the App Story

Fintech industry has got a sudden upsurge due to the millennials. A large part of their lives demands better experience and technology in everything they do. This effect made financial industry soar across the world. It resulted in big changes and benefitted people of all ages and economic status.

Stay tuned as we would be explaining to you what features are making fintech apps more appealing to millennials. Even which finance domains are showing larger prospects. Tighten your seatbelt, as this is just the beginning.

To dig deep into fintech software development, and fresh news from the finance industry, follow me @moumita85058426