Payment Gateway Integration In Apps – What You Need To Know

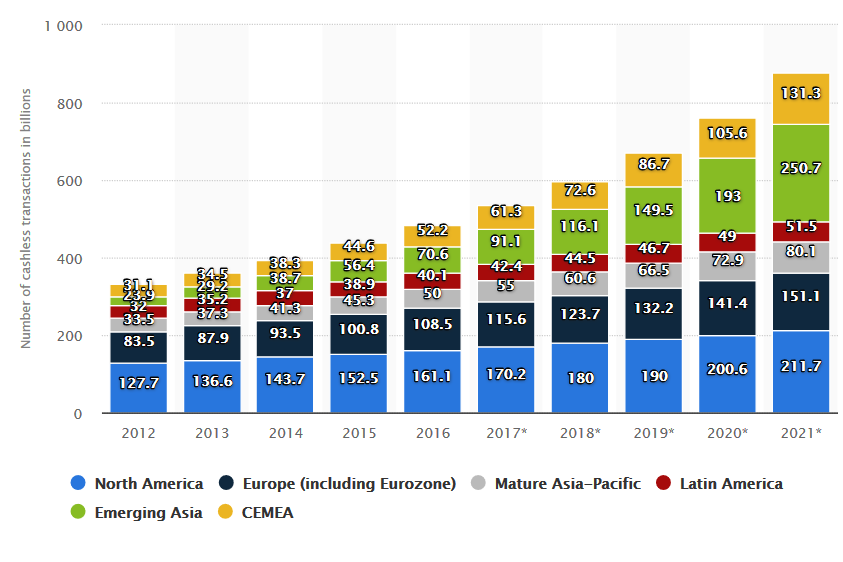

We are moving towards a cashless future, away from the hassles of a kind of transaction which involves complications like storage issues, overhead costs, slower checkout process. Undoubtedly, ecommerce and on demand industries are the major markets that benefited massively. Instant transactions with the help of wallets and other forms of payment gateway integration changed the business system for good.

As global markets are pushing for a cashless economy, online payment systems like Google Pay, Apple Pay, and PayPal are taking the lead when comes to safe and convenient online transactions. Very few merchants with an online business platform are left to utilise the advantages of payment gateway integration in mobile apps or websites.

The factors contributing to the success of cashless transactions are many. In the list of pros and cons, the pros heavily outnumber the cons, and for the right reasons. Given that tech experts around the globe are working to improve online checkout to eliminate the disadvantages completely. In the future, payment related errors should be zero.

Advantages Of Payment Gateway Integration

If you own a mobile application, or planning to create one, monetizing not just means more revenue for you, but more customers.

How so?

Related read: Google Tez vs Apps Like Paytm Wallet — The Game of Digital Payments

Maintaining and improving the product comes at a cost, but is the only way to keep your users from switching. Payment gateway integration in a mobile app is an investment worth every penny. Even if you are building an MVP for your startup, do not miss this feature. So, what are the advantages of payment gateway integration in mobile app?

1. Ease Of Transaction

Wallet and card payments solve several pain points. And payment gateway integration in mobile app is definitely an added benefit for your users. Customers find it convenient to use wallets over cash for the following reasons:

- No hassle of carrying cash

- Full utilization of discounts and coupons

- Zero hassle of changes

- Plenty of options to choose from, like wallets or cards

2. Increases Security And Safety Of Transaction

What benefits do businesses get by providing the convenience of online payments? With cash related security issues like loss due to theft, fake currency, they can assure safe transfer of money from customers. Payments gateways come with strong, unbreakable security, making the possibility of frauds and breaches not just harder, but close to impossible. It also reduces the chances of errors like miscalculation, giving more assurity to the users.

If you own an app that involves third party vendors, they would want to move their business to a platform that gives security to their revenues, as well as reduce the safety issues that comes with physical capital.

3. Faster Transactions

Imagine standing in a long queue, in a bank or a grocery store, waiting for your turn to make your payment. Only cash is accepted, and the cashier is taking forever for each customer. You would wish there was a better solution, right?

Now imagine there is an app for the grocery or the bank. With payment gateway in the mobile app for these, life just gets easier! Customers are opting for grocery apps like Instacart for faster checkout and home delivery.

4. Automation Grows Business

For any business, automation is an important growth factor. As consumers prefer faster transactions, they are likely to opt for a service with faster transaction and a safer payment option. In order to move on with the mechanised world with stiff competition, automation is not an option if you want to succeed.

Related read: How To Be The Next Uber For Everything? 20 Brilliant Ideas To Get Started

If you own a taxi app like uber, food delivery app like GrubHub, or any app with third party vendors, payment gateway integration will help you keep track of your their earnings. It will also reduce the chance of disputes between customer and vendor.

What Are The Types Of Payment Gateways?

Mobile payments can be broadly classified into two types of payments – In-App Purchases and Digital Payments. For all digital resources sold, such as subscriptions, in-app purchases are a compulsion on both Android and iOS platforms, from which Apple or Google charges a 30% commission for the first year.

But for all selling something real – a physical commodity, you are free to choose your own payment gateway, thereby avoiding paying a hefty commission to Apple or Google.

Are you wondering what is a payment gateway?

A payment gateway processes all forms of payments, i.e. credit card, debit card, bank transfer or any other forms of payment depending on their regional availability.

How Does Payment Gateways Works?

Users look through your products and chooses what they need. These products go into a cart. The cart is linked with a payment gateway provider. When a user checks out, he proceeds to a payment gateway provider.

The necessary information, i.e. credit card details or bank details are provided and the payment gateway processes the payment from the user’s card or bank and an approval code is provided. The amount is later remitted to your bank account linked with the payment gateway provider, after charging a transaction fee, usually in the range of 3-5%.

Payment gateways also provide mechanisms for refunds and handling cancellations.

Types Of Accounts

To implement a payment gateway, you’ll first need to have a merchant account on a payment gateway provider. Merchant accounts are primarily meant to hold the retailer’s money while it awaits transfer to an actual business bank account. There are usually two types of accounts that you can create – a dedicated merchant accounts or and aggregated merchant account.

How would you choose between the two?

1. Dedicated Merchant Account

If you are an individual business owner or a merchant, then a dedicated merchant account is tailor-made for your business transactions. But since this is a bespoke service, you would need to make some additional expenses to maintain thus account.

Different set of payment gateway providers will charge different fees. However, this gives you much more control of your funds and expenses; but it has some disadvantages as well. The purchase process takes longer and it takes a deep insight on the credit check.

2. Aggregate Merchant Account

An aggregate merchant account is one that combines several companies. For this account, every retailer will still need to offer some info about your company but being part of an aggregate merchant account is much less complicated.

PayPal and Stripe are examples of gateways that provide aggregate merchant accounts to their retailers. The disadvantage with aggregate merchant accounts is that they have less control over the period the money takes to complete the transaction process. But payments are faster, they are cheaper to maintain and are easier to set up.

How To Integrate Payment Gateway In Mobile App?

Payment gateway integration is not easy, but for app development experts, it is a cakewalk with the right technologies. To make this easier for you, we have discussed how to integrate payment gateway in mobile app in detail.

1. Credit Card Payment Integration With A Gateway API

There are a large number of payment gateways that allow you to process credit card transaction data through their APIs. At first glance, this looks very simple. But when you choose to integrate a payment gateway API, you place the responsibility for the security of credit card data on your own shoulders as the data now passes through your mobile app.

Related read: The Updated Way To Build An MVP App For Your Startup

Providing security for banking transactions is a very dedicated and specialized industry. Security breaches can land you in legal and financial troubles if you choose to shoulder the responsibility of security. This means you will be solely held responsible, if in case there is any misappropriation of funds or fake dealings. Also, your payment solution might not be compatible with all forms of payments that your users might find convenient for them.

This is where PCI-DSS compliance comes in.

2. Payment Card Industry Compliance

The first and most important requirement for any service that collects payments is to adhere to the Payment Card Industry Data Security Standard (PCI-DSS). You can find a list of service providers that are PCI-DSS compliant in the Visa Global Registry.

If you do not want to avail the risk of API, then you can choose this as a much safer option.

But the process of becoming PCI certified is tedious. It takes months of effort and you honestly don’t need that trouble if your app is going to simply pass card data to a gateway for long-term storage. But at the same time, anyone who accepts credit card payments — even those with mobile payment system integration — needs to comply with PCI-DSS rules.

Stripe and Braintree are major mobile payment gateways that can help you easily comply with PCI-DSS requirements.

They offer robust native libraries for Android and iOS which app developers love and ease PCI-DSS compliance by sending encrypted credit card data as a token. Thus, you can easily integrate mobile payment capabilities while avoiding most PCI-DSS compliance concerns because sensitive credit card data skips your servers.

They facilitate payments with Visa, Mastercard, Discover, JCB, Diners Club, American Express, and digital wallets.

They both charge owners in the US 2.9% plus $0.30 per successful transaction.

What’s Your Take On Payment Gateway Integration?

If you are thinking of launching an app and monetizing it, it is crucial to integrate a payment gateway. And if you already own an app, and thinking of adding this useful feature, we are with you!

Over our 9 years of expertise, working with hundreds of startups and fortune 500 companies, we understand the client’s needs like no other. And after helping numerous firms grow their business by monetizing, payment gateway integration is a cakewalk for us!

So if you have any queries regarding online payment integration, do not hesitate to contact us, as a top mobile app development company, we are happy to help!