A Comprehensive Guide On P2P Payment App Development

The Digital revolution has successfully touched almost all aspects of our lives, so how come something as essential as money gets left out? Consumer money evolved its form over the years, transitioning from paper notes and coins to plastic cash (bank cards) and further to digital wallets. The peer-to-peer money transfer app is the latest addition to the changing forms of money exchange.

With a P2P app on your phone, you can make payment to your Uber cab or settle the month’s rent with your property owner or quickly split your brunch with your friends at the tap of a finger.

With a P2P app on your phone, you can pay your Uber cab, settle the month’s house rent, or split your lunch bill at the tap of a finger.

You do not need to walk to the ATM or have the exact balance in cash or wait for the money to be transferred anymore. At the forefront of this new trend in the transaction, processes are reliable and trustworthy apps like Venmo, Google Pay, Apple Pay Cash, PayPal, and Zelle.

So, what exactly are P2P payment apps, and why are they so popular? Let’s find out.

Success Rate Of P2P Payment App Development

Success Rate Of P2P Payment App Development

PayPal, one of the leading P2P payment apps in the market and also the owner of Venmo, registered 325 million active accounts in the first quarter of 2020, according to an article by Wisdom Plexus. The market is currently registering a growth rate of 9.76% globally and if the same is maintained, will grow to the size of $3217.34 million by the end of 2024, says Advance Market Analytics.

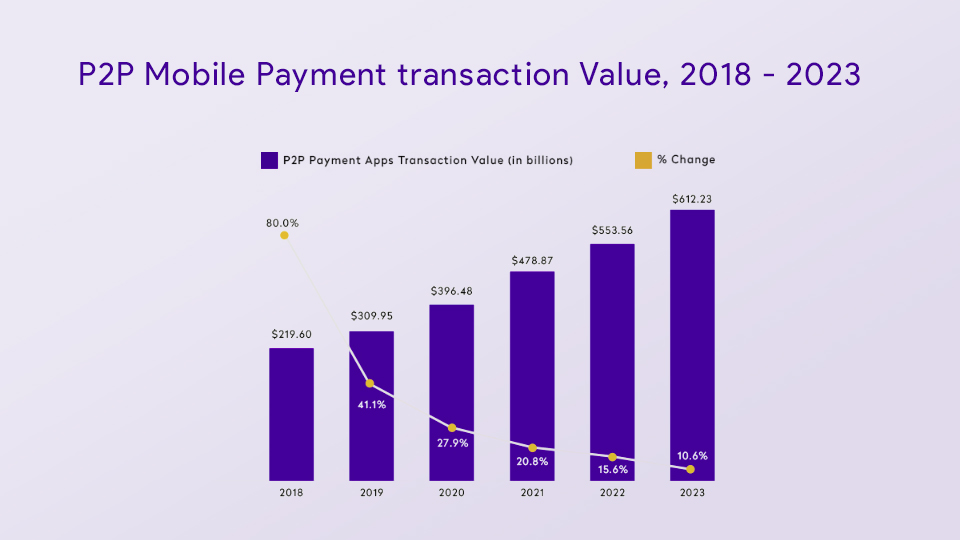

In a graph presented by Excellent Web World, it can be seen how P2P mobile payment transaction value has gone up to $309.95 billion at the end of 2019 from $219.60 of 2018, and is slated to reach $612.23 by the year 2023.

Source: https://www.excellentwebworld.com/build-p2p-payment-app-like-zelle/

Source: https://www.excellentwebworld.com/build-p2p-payment-app-like-zelle/

Now, these are only the dry facts and figures. Now let’s come to the more exciting bits of P2P payment apps, like, how to develop an app suitable for the market. The trend of P2P payment app development is something that is catching the attention of every business which wants to make it in the financial sector. Apps like Venmo have shown the way that this can be an extremely profitable business, but if only done right.

Venmo– An Inspiration For P2P App Development

Venmo is a service owned by PayPal but has slightly different functionalities than its parent app, PayPal. After the first quarter of 2019, PayPal announced that Venmo has achieved 40 million users. While PayPal is used by a large number of businesses as well as consumers for large scale transactions, Venmo is more for the grocery run or paying your babysitter. All you need to do is download the app, create an account, and link your bank account or credit card. After that, you will be set to send, request, or receive money using the in-app wallet from other Venmo users.

So if you want to develop a P2P payment app in 2020, you have to make sure you nail all the pros of the popular apps out there and steer clear of their cons.

The process of P2P payment app development is not the easiest task to accomplish. But at the end of the process, there are certainly great benefits to reap.

Related Read: Google Tez vs Apps Like Paytm Wallet — The Game of Digital Payments?

Step-By-Step Guide For P2P Payment App Development

To step into the game of the P2P payment app building, you need to have a well-crafted strategy in place. From here on, the article will describe how to build a P2P payment app, what should be its features and challenges, and other things you need to know.

Step 1: Determine Your Business Model

Step 1: Determine Your Business Model

The first thing you need to do is come up with a blueprint of your P2P app. Here you will have to decide the size, target location, platform, functionalities, and revenue structure of your app. It helps if you already have an app that you want to refer to.

PayPal and Venmo are the best references for standalone P2P apps. On the other hand, Zelle or Google Pay are great references for bank-centric P2P apps that function directly through bank transactions.

Step 2: Do Your Budget

Determine how much you are willing to spend on building the P2P app. You would obviously want to keep the cost down as much as possible, but try and keep it in line with the business model you have set up in the first stage.

Step 3: Hire A Reputed Developer

Unless you are an expert developer yourself, it is best to hire a professional to develop the app. With payment apps, you cannot take any risk regarding safety and security. One mistake of yours could be putting all of your users at risk of financial harm. It would be wise to leave the technicalities of P2P payment app development with the experts.

Related Read: Hire Mobile App Developers to Give Your Product An Enterprise Friendly Boost

Features To Include In The P2P Payment App

Everybody knows P2P payment apps can send or receive money via a contact number or QR code. But that is not all the app is made of. There are many other features that must be included in a proper peer-to-peer payment app without which it will not be able to survive in the market.

1. Push Notifications

The purpose of the notification is to keep the user aware of each and every activity going on. Apps like these are directly connected to the user’s money, so they would like to be in the ropes of any and all app activity. The user should receive notifications of any payment done or received, payment requests, unauthorized login attempts, etc.

Tech stack: Chrome notifications, Rest APIs, APNS, Amazon SNS, and Firebase cloud messaging.

2. Transaction History

Every P2P app must have a feature where the user can access their transaction details through the app mentioning the amount, recipient, or sender of the amount, date, and unique transaction ID. It is for the sake of user’s convenience as well as for financial safety.

Tech stack: APIs

3. Two-Factor Authentication

A P2P app should be protected by two-factor authentication for zipping tight security. The first OTP will be asked during logging into the app each time (this layer can also be cleared with a fingerprint sensor, explained later) and the second OTP will be asked while authenticating an amount to be debited from the wallet or bank account. This double-layered security is an absolutely mandatory feature of not just peer-to-peer money transfer app, but of all digital finance solutions.

Remember, when you are making an app for the finance sector, your user will be trusting you with their money, sometimes with all their savings as well. It is your responsibility to not make them regret that.

Tech stack: Firebase, Nexmo, Twilio, other 3rd party SDKs

4. Money Transfer System

Most popular standalone P2P apps allow users to transfer their money back to their bank accounts from the app wallet. It is not mandatory, but if you include this feature in your app it will substantially enhance the user experience and that is all you are looking for here, is it not?

Tech stack: ACH

5. Fingerprint Lock

You can keep fingerprint lock as a replacement for the first OTP authentication, or you can keep them both for even stronger security. A fingerprint lock feature will make sure there is no theft of sensitive information and the rightful user of the device and the app is in charge of the app activity.

Tech stack: Biometric authentication, optical fingerprint, capacitive sensors

6. Chatbots

Like all other apps, P2P payment platforms also require chatbots for responding to complaints, queries, and clarifications, handling grievances, app assistance, and other customer service solutions. You can customize your chatbot to deal with a wide range of issues that might arise while a user uses the app, starting from payment failure to wrongful fund transfer to any case of app malfunctioning.

Tech stack: Zendesk, Microsoft Bot Framework, Facebook messenger chatbot, Amazon Lex.

7. Bills And Invoices

There should be a feature that allows users to scan a bill or an invoice for sending it to another user who owes the money. It can be useful for things like splitting a bill or getting paid for a freelance job. The app must also generate an invoice for every transaction which will be delivered to both the sender and the receiver via the app.

Related Read: Payment Gateway Integration In Mobile Apps – What You Need To Know

Challenges Faced In P2P Payment App Development

Now that you have an idea of how to build a P2P payment app, it is time to face some of the challenges. It obviously comes with its fair share of obstacles and it is best that you are aware of them as you step into the wild waters.

1. Safety And Security

Maintaining the security of a P2P app is one of the biggest concerns of an app developer, and one of the biggest challenges as well. Hackers and phishers look for any opportunity to infiltrate your firewall of security and steal confidential and sensitive data.

Fool-proof platforms like PayPal have been hacked previously, so you can understand the amount of threat any P2P app stands to face.

Every P2P app must be in line with the Payment Card Industry or PCI guidelines to ensure proper safety and security. The guidelines demand your app too –

- Secure confidential information

- Have strong access control standards

- Continuous update of security policies

- Maintenance of secure network and system

- Vulnerability management system in place

- Regular testing and monitoring of networks

2. Currency Conversion

2. Currency Conversion

Currency conversion is another challenge P2P apps face. With around 180 active currencies all around the world, conversion of money to one currency to another in case of international payments becomes quite the challenge.

3. Dispute Management

It is very obvious that people are sensitive about money matters and they will not take any dispute lightly where their money is involved. Sometimes integration issues of P2P apps can lead to discrepancies in payment status, where the payer party gets notified of the amount debit while the payee does not receive it. These sorts of issues require immediate attention or can lead to a loss of users in the long run.

Related Read: Did Your App Fail? Here Are 6 Possible Reasons Why(& How to succeed)

The Future Of P2P Apps

The forecasted statistics of P2P apps in the coming years have already been discussed. But what can one expect from the market as a whole?

Cryptocurrency is definitely going to be an exciting addition. Blockchain technology has already helped weed out corruption and errors in the transaction process by decentralizing the record across several thousand devices around the world and prevents complete control of any single body over the transactions. All these systems come together to acknowledge and approve the validity of any transaction made through complex algorithms, forming a chain of transactions – a blockchain.

The P2P market can definitely expect more competition as well. Newer and newer apps are coming up every day and pushing the established brands to up their game and do better than before.

Who knows, one of the apps that do make big might just be yours.

All Set To Be The Next Venmo?

Change is the only constant thing in the world. Everything survives by transforming. So, just like the world witnessed several levels of transition from vinyl records to cloud computing, the genre of finance has also had an evolution of its own. And at present, we might be standing on the verge of a gigantic milestone.

More and more people are deciding they would rather use digital money instead of physical money, and this is a trend that is only going to go upwards.

Have an amazing P2P Payment App Development idea in mind? Then let our mobile app development experts help you out. If there was something holding you back so far from investing in P2P payment apps, throw it out of the window and make the leap now. When the market booms, you would want to have a front-row seat for the grand show.